What Experts Say Will Happen with Home Prices Next Year

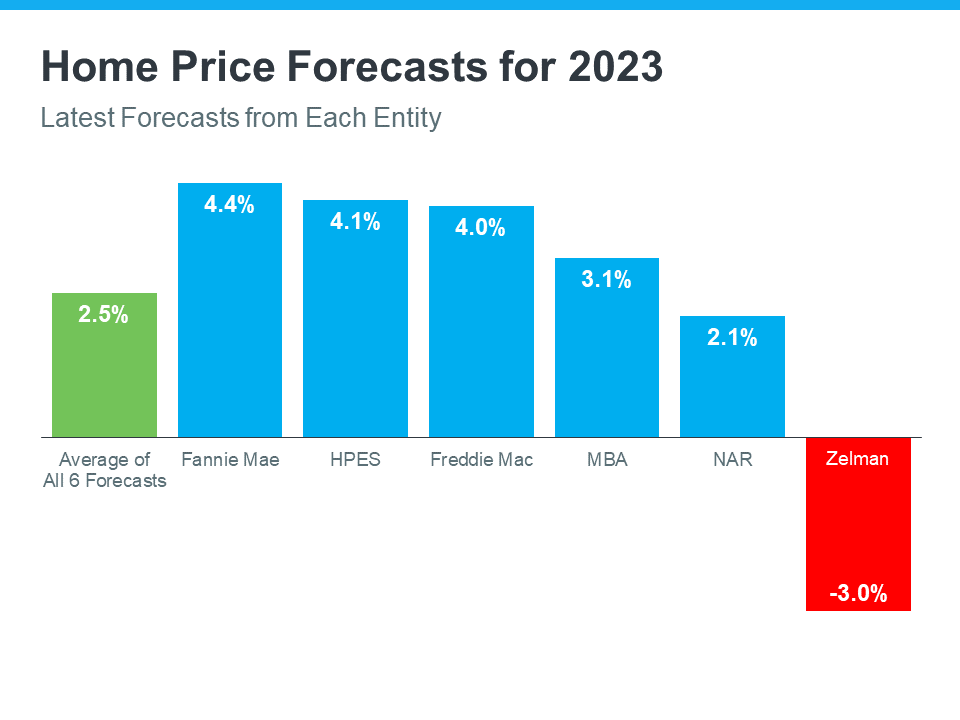

Experts are starting to make their 2023 home price forecasts. As they do, most agree homes will continue to gain value, just at a slower pace. Over the past couple of years, home prices have risen at an unsustainable rate, leaving many to wonder how long it would last. If you’re asking yourself: what’s ahead for the price of my home, know that experts are now answering this question, and its welcome news for homeowners who may have been led by the media to believe their home would lose value.

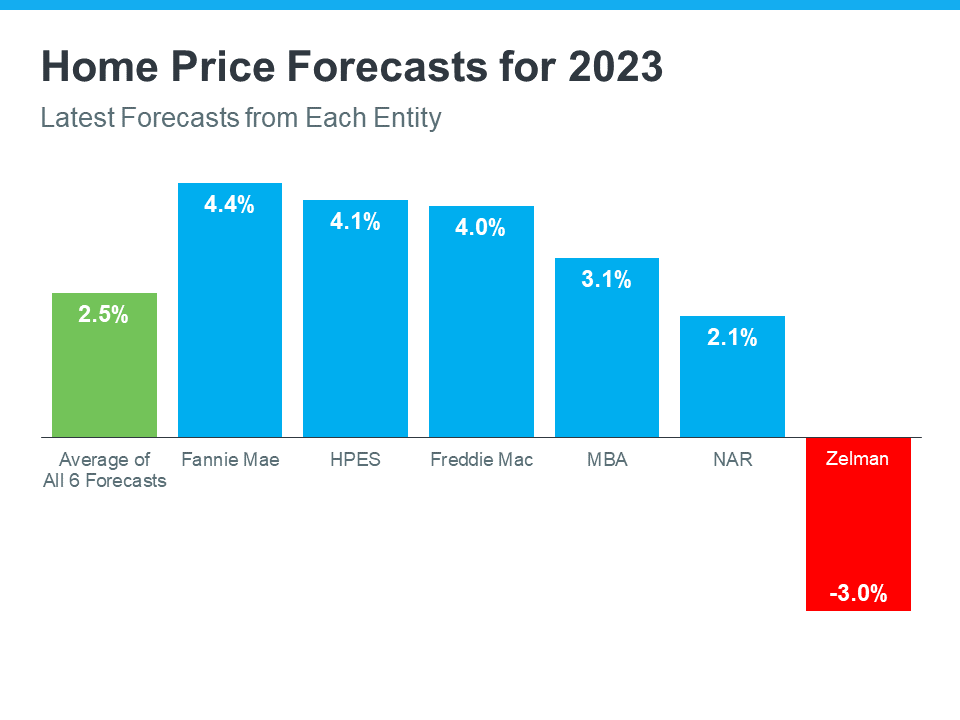

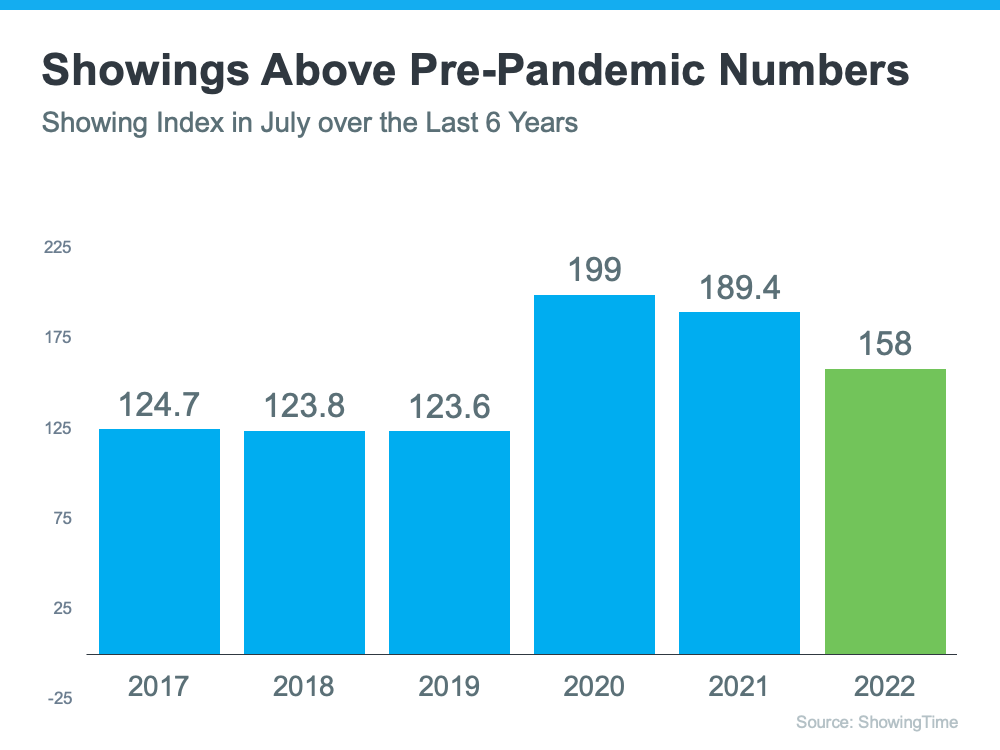

Historically, home prices have appreciated at a rate near 4%. For 2023, the average of six major forecasters noted below is 2.5%. While one, Zelman & Associates, is calling for depreciation, the other five are calling for appreciation. The graph below outlines each expert forecast to show where they project home prices are going in the coming year.

To understand why experts are calling for appreciation next year, look to the economics of supply and demand. Dave Ramsey, Financial Expert, says this:

“The root issue of what drives house prices almost always is supply and demand . . .”

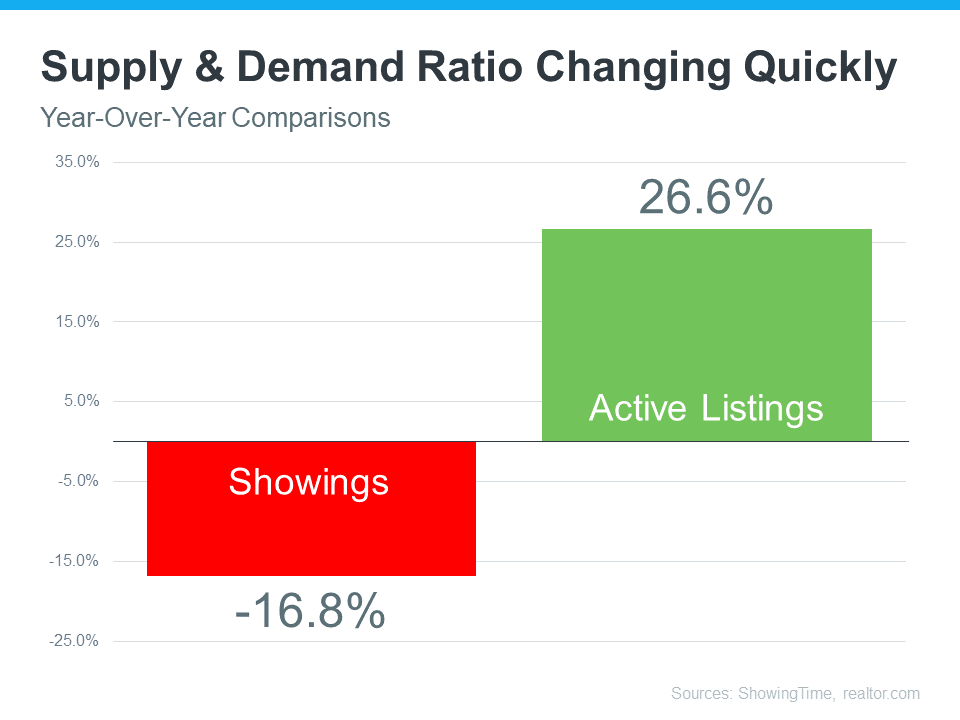

Two things are driving home prices upward. First, the undersupply of homes on the market is an issue we continue to face in this country. We still don’t have enough homes on the market for the number of people that want to buy them. To further that point, we’re still in a sellers’ market nationally, and in that scenario, home prices tend to appreciate.

Second, millennials are moving through their peak homebuying years. Since they’re the largest demographic behind the baby boomers, demand isn’t going away any time soon.

Bottom Line

Experts are calling for home prices to appreciate next year, although at a slower pace than the previous three years. The reason for this is simple. The dynamics of supply and demand are playing out in real estate and will continue for many years to come.

Let’s Chat!

|

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/15085222/20220916-MEM-1046x1558.png)

![Why It’s So Important To Hire a Pro [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/08160740/20220909-MEM-1046x1814.png)